COVID-19 and the US Stock Market: How Investors Can Capitalize

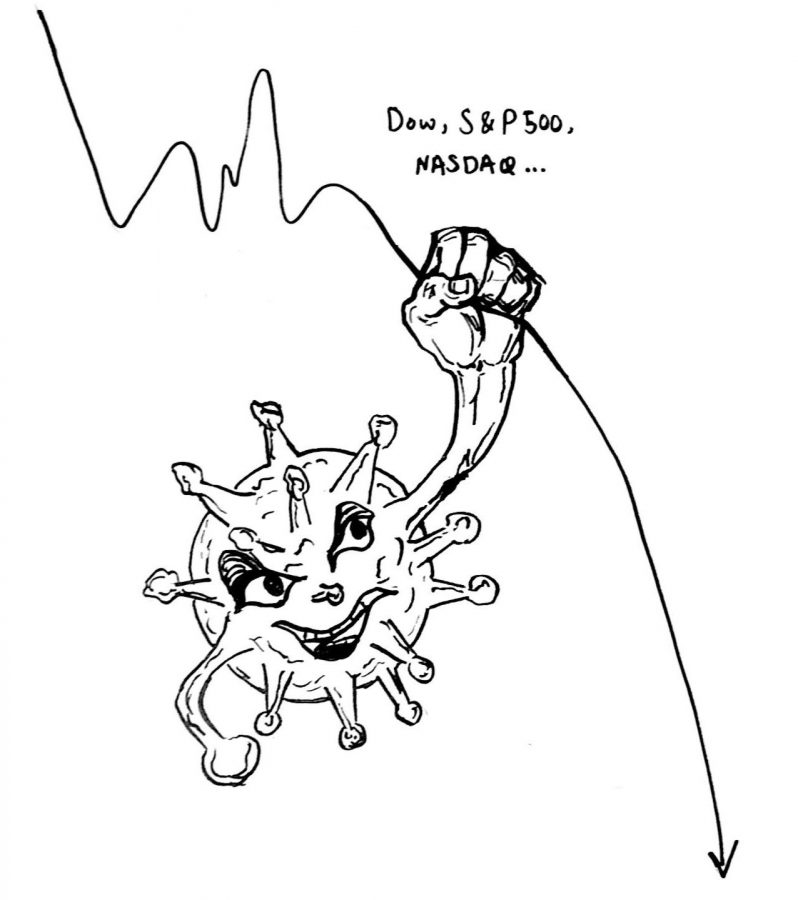

“Coronavirus: … Dow, S&P 500 in Worst Day since 1987,” “Worst First: Dow Jones Industrial Average On Pace For Deepest Q1 Loss in History as End of Quarter Looms,” and “Dow and US stocks plunge again: March 16, 2020,” are just a few of the headlines that have surfaced since the start of the COVID-19 outbreak in the United States. Many investors have been “panic-selling” their stocks, production chains from China have been broken up due to the outbreak in Wuhan, and many brick-and-mortar stores have been temporarily closed as the virus spreads around the world, causing health and economic crises. While there are many economic worries that arise from the crisis, savvy investors may be able to emerge intact or even improve their position.

Before delving deeper into how COVID-19 specifically affects the US stock market, it is important to remember that there are three key components that can change a stock’s price: supply and demand in the market, the company’s success, and other outside factors.

-

- If there are more buyers than sellers for a company’s stock, the price will increase. If there are more sellers than buyers, the price of the stock will go down.

- If the company is able to successfully provide its good(s) and/or service(s), and make a profit, the company will be valued better, therefore causing the stock price to go up. The company’s management team and board must also be experienced. A profitable and growing company also helps with it’s success.

- Exogenous factors such as the events in the news, the government, liquidity of the stock, investor demographics, competition, and strength of the company’s sector, are a few examples of outside factors.

When the growth of COVID-19 cases in the United States skyrocketed, the economy was heavily impacted in a negative way. With many companies forced to slow or cease production and distribution, shut down physical locations, and lay off employees, stock prices plummeted. Without the financial security of a job and steady income, many investors panicked and sold their shares in companies, fearing that they may lose more money. These two factors caused the stock market to correct itself.

One thing to keep in mind about the stock market is that people always overreact to situations. The majority of transactions are fueled by emotions about stocks (fear, excitement, etc.). Also remember that market corrections (whenever the market dips) that have brought the US stock market into bear territory (whenever a stock drops 20% from it’s highest high) have occurred nine times since 1920, and the market as a whole has fully recovered over time in each case. Recovery from the current correction could range from a few months to a few years. During the last three market corrections, the average length of the correction was approximately 16 months and 20 days. During all three of these corrections, the S&P 500 also dipped below 30%, similar to it’s current 33% dip.

Although one may think that nothing good could come out of this pandemic, there is a very strong chance to capitalize on the market dip. Considering that many companies’ share prices have dropped significantly, it may be an opportunity to buy. This brings me to my first piece of advice: if financially capable of doing so, buy quality stocks in companies with good management and governance. Because many companies’ stocks are currently low, and the high chance that the market will fully recover, you have a chance at gaining massive profits. Keep in mind, it may take months or years for the prices to rebound, so be prepared to wait for the returns.

Secondly, if you already own stock in quality companies, do not panic sell. The market is certain to rebound and selling stocks with current losses will do nothing except maximize losses.

Lastly, plan for the long term. Thinking about short term gains/losses in the stock market rarely works in favor of the investor, especially during a bear market as it is extremely hard to predict, so buy stocks that you think can benefit you in the long run.