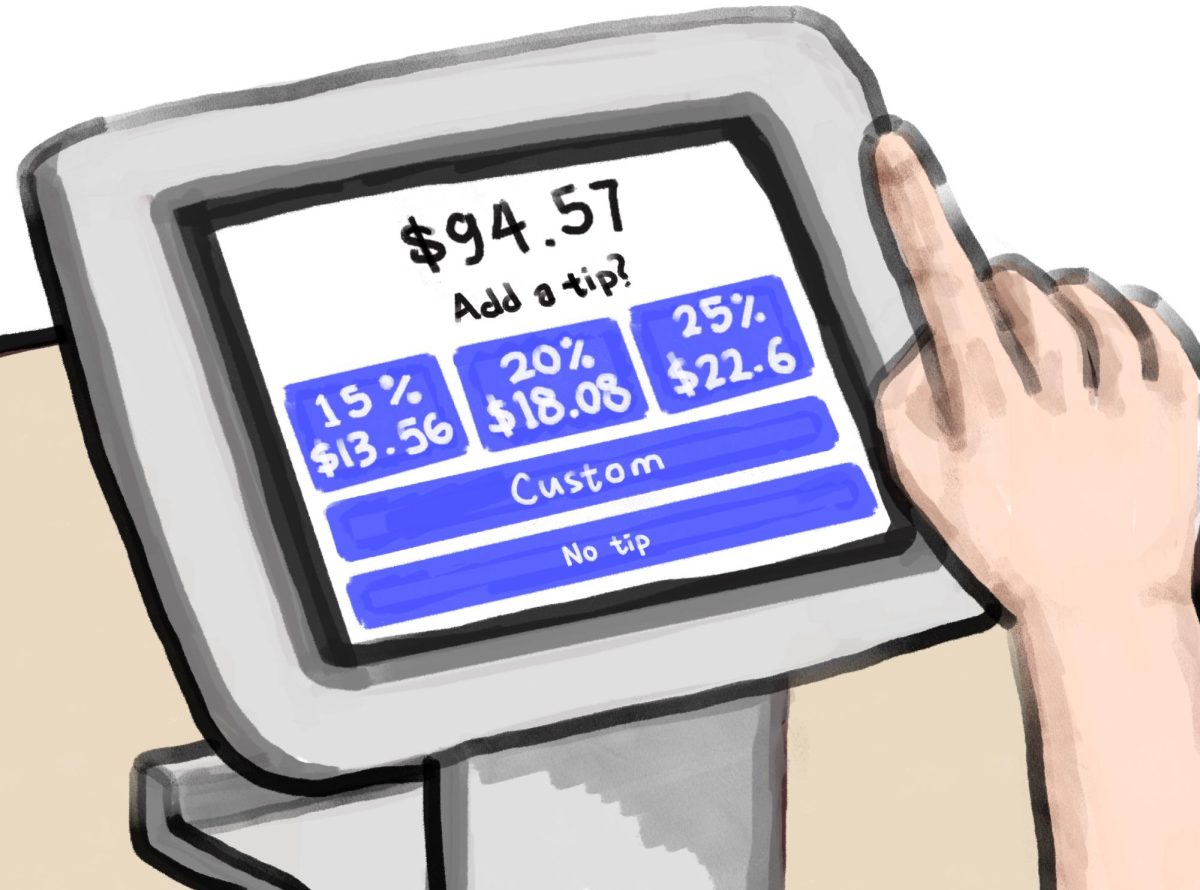

How many times a week does a barista flip around a screen asking you to “add a tip” with pre-set options of 15%, 20%, or even 30%? How often do you guiltily click the small “no tip” button at the bottom of the tablet? Or do you click the 20% button—embarrassed not to tip, but not expecting to pay so much for your single cup of coffee?

Large pre-loaded tip options create increasing uncertainty about prices for consumers, reduce employers’ responsibility to pay a living wage, and unfairly transfer that burden onto customers.

According to the 2023 YouGov/Eurostrack Survey, the United States is one of the highest-tipping countries in the world in every category of work. Tipping 20% has become the norm in the U.S. Pew Research reports that around 72% percent of Americans tip. Tipping began as a way to incentivize excellent service, but nowadays, tips are ubiquitous.

With the increase in touch-screen payment technology, customers are constantly bombarded by a slide asking for tips ranging from 15-30%. In the past, customers were faced with a tip jar; however, new touch-screen payments take the humanity out of tipping.

What was originally an act that could be seen by the server is now hidden on a screen. Since tipping has become an expectation, the practice of responding to tips with gratitude has diminished.

According to Bankrate’s 2023 tipping survey, 66% of Americans have a negative view of tipping. This clearly shows the effect of our current tipping culture. If a cup of coffee in the United States costs $6, with a tip of 30%, a single cup of coffee now costs $8. The quality of the coffee, service, and presentation is immaterial—the tip is almost like a tax that is expected regardless of whether customers are satisfied with their coffee and service.

The expectation that customers will add large tips to their bills is also used as justification by employers for paying employees less than minimum wage. The U.S. Department of Labor sets $2.13 per hour as the cash minimum wage for tipped employees, even though $7.35 per hour is the national minimum wage in jobs where tipping is not expected.

Employers in sectors where tipping is expected are allowed to assume that 71% of an employee’s wage will be supplied by consumers’ tips, and employees, in turn, must rely on the far-from-guaranteed generosity of customers to (possibly) earn the minimum wage.

Consumers cannot be held legally liable if their tips do not bring employees’ wages to a certain minimum level; however, employers can be. Allowing employers to skirt legal requirements for minimum or living wages based on tips places unacceptable financial risk and uncertainty on employees.

One possible solution to these problems is establishing a “no-tip” policy in certain places of business, which would require employers to shoulder the responsibility of paying a minimum or living wage.

Yes, employers would have to transfer some of that added cost to the consumer by raising the price of goods and services. However, this would ensure that employees receive a consistent and reliable wage, while consumers can predict what they will be spending. The decreased social pressure, guilt, resentment, and confusion would create a better experience for all parties involved.

Regardless of what businesses intend to do with respect to tipping, the increasing societal discontent with tipping culture in the U.S. indicates we are headed to a much-needed change.